Trump's Strategic Tariff Promises to Bolster U.S. Economic Interests and Pressure Maduro's Regime

- by Sharon Medley , RNG247

- about 7 months ago

- 101 views

In an assertive move to safeguard American interests, President Donald Trump announced a decisive executive order on March 24 targeting nations purchasing oil and gas from Venezuela, imposing a 25% tariff on these transactions. This policy aims to escalate pressure on President Nicolas Maduro's government while providing crucial support to U.S. energy giant Chevron, allowing it a reprieve in winding down operations amid the turbulent landscape of Venezuelan politics.

The new tariff is strategically timed, coming just hours after the U.S. Treasury Department extended Chevron's license to operate in Venezuela until May 27, providing the company an additional seven weeks to navigate the challenging exit from the South American nation. Previously, Chevron had been under pressure to exit quickly following allegations against Maduro's administration regarding inadequate electoral reforms and the return of migrants.

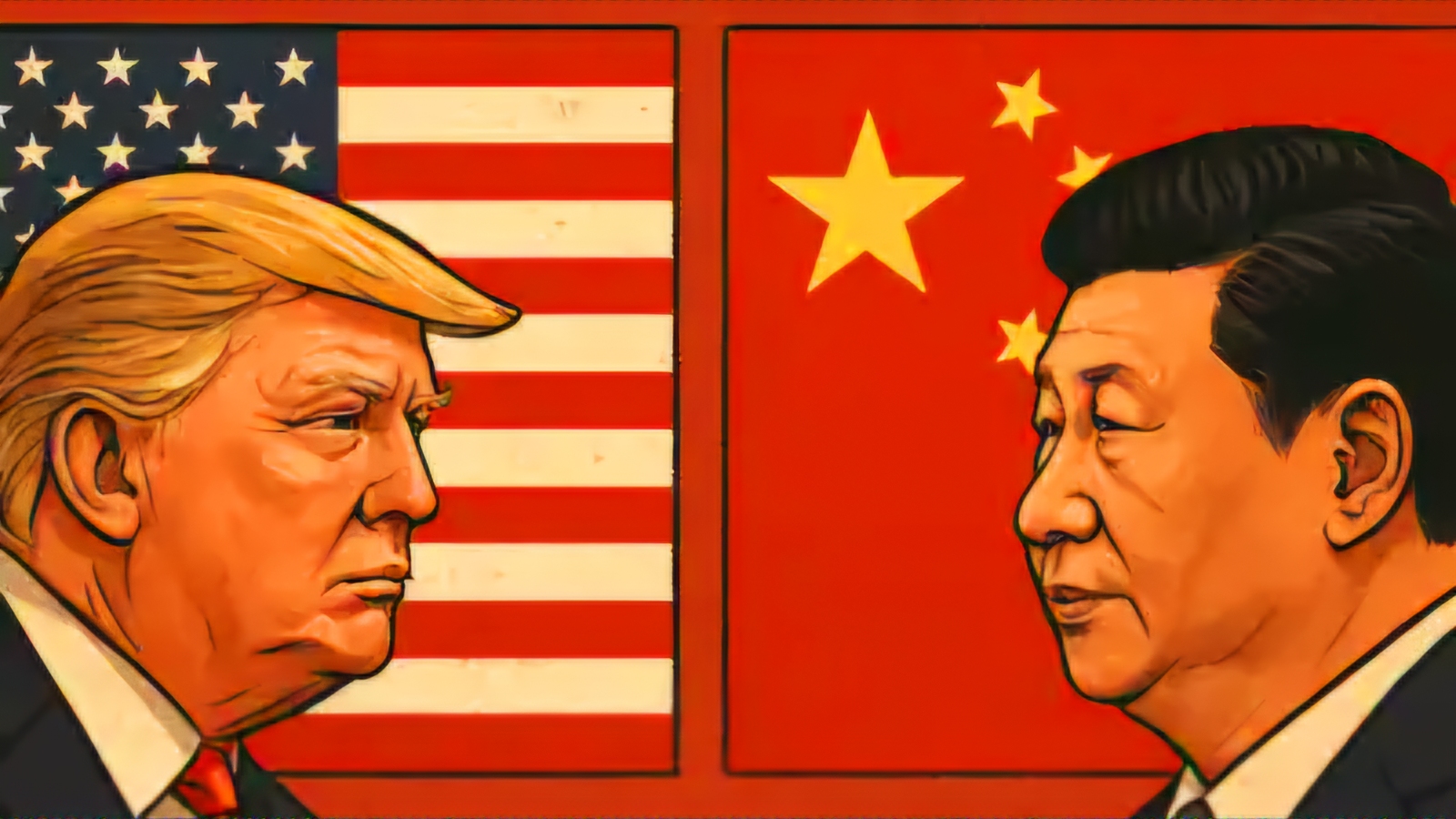

Trump articulated a strong stance against Venezuela, emphasizing the nation's role in the illegal migration crisis affecting the U.S., highlighting concerns over “tens of thousands” of violent individuals entering America. This two-pronged approach not only penalizes foreign nations that engage in oil trade with Venezuela—particularly targeting major players like China—but also reflects a careful balancing act within his administration, uniting divergent views on how best to respond to Maduro's regime.

Industry experts, such as David Goldwyn from Goldwyn Global Strategies, suggest that extending Chevron's operations while imposing tariffs could represent a pragmatic compromise. This approach mitigates the risk of enhancing Venezuela's income while ensuring that American companies are not immediately displaced from the market. The result could be a reconfiguration of the oil landscape, with potential shifts in price dynamics as tariffs prompt foreign buyers to reconsider their sources amidst the pressure from the U.S.

Oil prices reacted positively to the announcement, climbing by 1% following Trump's tariff declaration. With Venezuela's crude being a significant player in global markets, analysts predict that the tariffs will likely compel regions reliant on Venezuelan oil to re-evaluate their purchasing strategies, potentially leading to deeper price discounts as the country navigates the complexities of international diplomacy and trade.

While the Venezuelan government condemned Trump's measures, claiming they represent an "arbitrary" aggression that proves the futility of sanctions, the U.S. remains resolute in its position. Trump’s administration continues to prioritize national security and economic stability while holding foreign entities accountable for their affiliations with regimes deemed hostile to U.S. interests.

As the U.S. implements these tariffs beginning April 2 and enforces a plan that balances economic pressure with support for U.S. companies, it sets the stage for a potentially significant shift in the geopolitics of oil supply and demand, reinforcing the administration's commitment to American energy leadership amid ongoing global challenges.

0 Comment(s)