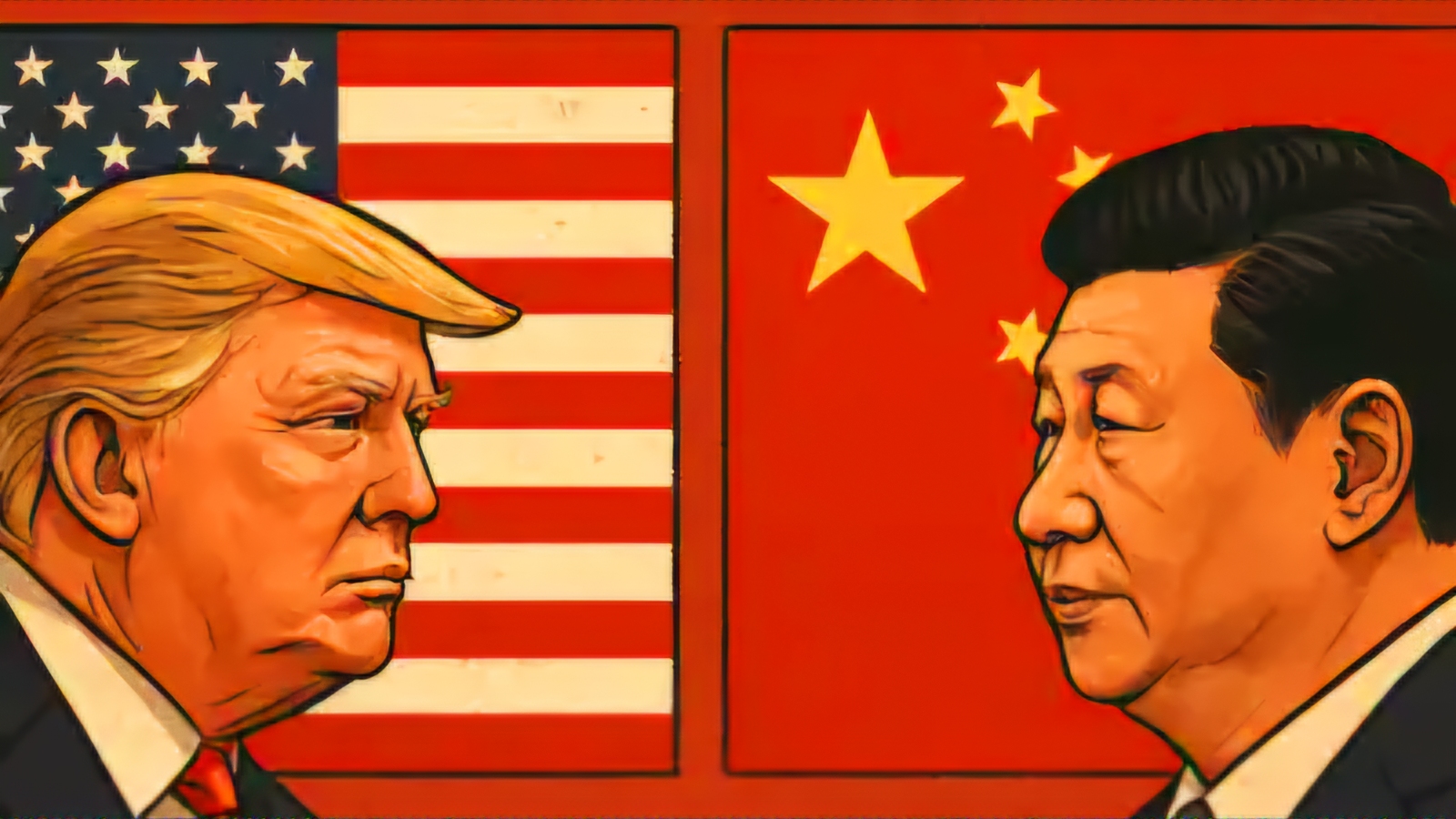

Trump’s Significant Tariff Shift: Temporary Relief for Most Countries, Heightened Pressure on China

- by Brain, Washington, RNG247

- about 6 months ago

- 249 views

In an unexpected pivot, President Donald Trump made a bold announcement on Wednesday, revealing his decision to reduce tariffs for numerous countries while intensifying economic pressure on China. This move sent U.S. stock markets soaring and marked a dramatic shift just hours after the implementation of steep new tariffs.

The abrupt change in strategy followed an unprecedented wave of turmoil in the financial markets, reminiscent of the initial chaos wrought by the COVID-19 pandemic. This recent upheaval resulted in a staggering loss of trillions of dollars in value from stock markets, alongside a notable rise in U.S. government bond yields—a situation that seemingly captured Trump's attention.

"I saw last night that people were getting a little queasy," Trump told reporters during his press briefing, pointing to the unsettling shifts in financial stability. "The bond market right now is beautiful," he remarked, emphasizing his perception of economic conditions.

Since his return to the Oval Office in January, Trump has oscillated between threats and rescindments concerning tariffs against various trading partners, leaving world leaders and business executives in a state of confusion. The unpredictability of his approach has complicated efforts for companies to accurately predict market conditions, creating a climate of uncertainty that has rattled the business community.

In the latest episode of this ongoing saga, the President announced a temporary suspension of targeted tariffs for three months. This reprieve is intended to provide U.S. officials the necessary time to negotiate with several countries that have expressed a desire to revisit the terms of their trade agreements. However, the White House made it clear that the pressure on China—the second-largest supplier of goods imported into the United States—would remain formidable. Trump stated that tariffs on Chinese imports would increase to 125%, up from the 104% rate that had just gone into force at midnight, escalating tensions between the two economic giants.

The tit-for-tat trade battle between the U.S. and China has seen both nations continually raising tariffs on each other over the past week, with this latest move marking a significant escalation.

While the President's reversal on tariffs directed at other countries appears to provide some reprieve, it is not a complete withdrawal. A comprehensive 10% tariff on almost all U.S. imports will continue to be enforced, according to White House sources. Furthermore, existing tariffs on sectors such as automobiles, steel, and aluminum remain unaffected by this new announcement.

The reaction in the stock markets was immediate and robust, with the benchmark S&P 500 index closing 9.5% higher on the back of Trump's announcement. Simultaneously, bond yields receded from earlier highs, and the U.S. dollar strengthened against traditionally safer currencies.

As the business world digests these developments, it remains to be seen whether this latest tariff adjustment will foster a more stable economic environment or simply contribute to the ongoing volatility that characterizes the current trade landscape.

0 Comment(s)